Employment & Labor Law

Increased Salary Minimums

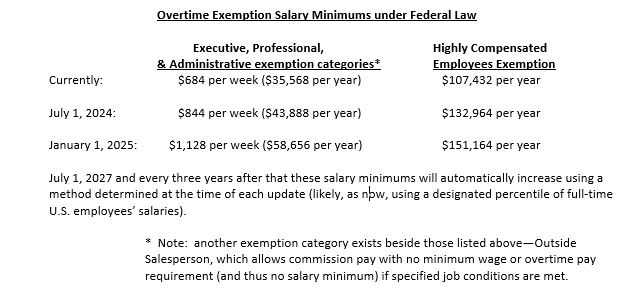

The U.S. Department of Labor (“DOL”) is raising the minimum salary required to be paid employees otherwise allowed to be exempted from overtime pay. The last increase of these rates was in 2019.

By way of brief background, the Fair Labor Standards Act, a Great Depression Era federal statute that established minimum wages and overtime pay requirements, allows employers to exempt employees from overtime pay if those employees meet both job duty and salary basis requirements established by the DOL. The DOL has now issued its Final Rule for the new minimum salary levels required for exempt employees. This is what employers must at least pay these workers in order to not have to give them time and-a-half overtime pay (whenever they work over forty hours in a week). The following chart provides the current minimum salary levels and the future increases under the new Final Rule, with their effective dates.

Please also note that Pennsylvania had adopted a higher minimum salary requirement for exempt employees that was to increase to $875/week ($45,500/year) in October 2022; but these state regulations were abrogated by Act 70, effective July 9, 2021, so only the federal minimums apply to Pennsylvania employees for the time being.

The new federal Rule raising the minimum overtime exemption salary levels may generate litigation challenging it occurred with the 2016 Rule that was blocked in the courts, until a new rule was issued in 2019 which is currently in effect. It remains to be seen if a court enjoins the new Rule. If it goes into effect as we predict it will, employers’ options generally are to adjust exempt employees’ pay to at least these levels or to start paying them overtime.

An important note and reminder for all employers is to periodically review whether you are properly classifying employees as exempt. This requires more than just paying the applicable salary minimum. It requires two other important and more complicated compliance areas. One is to pay on a salary basis, which involves paying the employee’s full salary regardless how much work the employee does in any week (as long as they do some work in the week), with several exceptions permitting paying less than full salary provided the detailed requirements of an applicable exception are met. Employer pay rules or practices that subject exempt employees to impermissible deductions from pay run the risk of losing the employer’s overtime exemption for all employees covered by those rules, even including those employees who never had an impermissible deduction—resulting in employer liability for overtime backpay for all these covered employees over the prior two or more likely three years (there are also some employer defenses to inadvertent deductions).

Employers should also be alert to whether they are properly applying the job duties tests that must be met as well in order to treat an employee as exempt from overtime pay. These tests, which are different for each of the different exemption categories (e.g., executive, professional, administrative, highly compensated employees), are not easy to apply given their complicated and subjective definitions.

We also have a self-guided questionnaire for a nominal price that walks you through many of these compliance subjects if that is of interest to you.

If you would like help with determining your exempt employee compliance or have questions on any of the above points, please contact Craig Brooks or Brian Lipkin.

About Us

Claims and suits brought against employers by employees are a large part of the cases being handled by the Employment lawyers at Houston Harbaugh. We focus on assisting and counseling our clients to be positioned to avoid claims, and if the claims are brought, to be prepared to defend against them.

Craig M. Brooks - Practice Chair

An employment and labor attorney, Craig primarily represents management, providing advice on how to handle employee issues and actions, as well as defending or pursuing claims in court and before government agencies on matters.

An employment and labor attorney, Craig primarily represents management, providing advice on how to handle employee issues and actions, as well as defending or pursuing claims in court and before government agencies on matters including:

- Employment discrimination claims

- Wage and hour matters

- Sexual and other harassment investigations and claims

- Family and Medical Leave Act

- Wrongful discharge

- Labor/Union matters

- Restrictive covenants

- Affirmative action programs

- Defamation

- Privacy

Craig also represents individuals with advice and pursuing claims arising out of their employment.